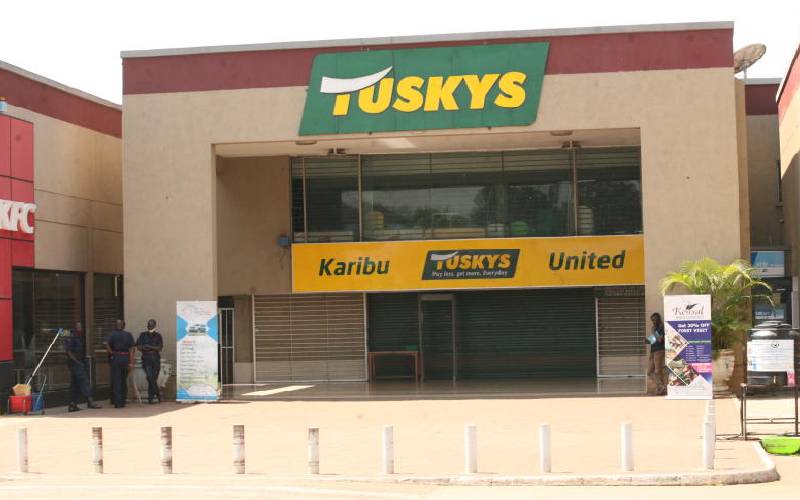

How the mighty fall: The sad collapse and death of Tuskys Supermarket

Misfortune has struck Kenya’s top-level supermarkets in recent years, claiming the lives of national and regional titans, with Nakumatt being the most prominent loss.

Tusky’s supermarket, Kenya’s second-largest chain, carried all the potential of being the country’s next dominant power in the retail business at the time of Nakumatt’s demise.

But that was never going to happen.

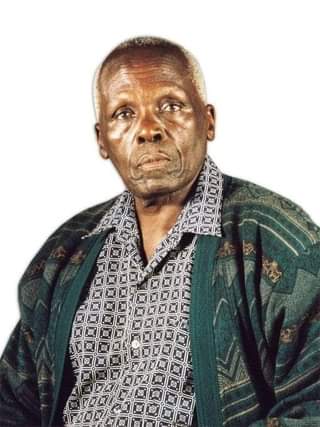

Tuskys Supermarket is finally on the dead-bed, with Mzee Joram Kamau’s 30-year-old dream stumbling under the weight of debt and mismanagement.

Tuskys was ordered liquidated by the Kenyan High Court on May 31, 2023.

The court ruled that there was no possibility of saving Tuskys and that liquidation was the best choice for the company.

The administrator was appointed by the court to manage the liquidation process and guarantee that the company’s assets were liquidated to pay off its obligations.

The liquidation procedure is expected to take several months, and the amount of money recovered by creditors is unknown.

Tuskys had been reeling under debts of up to 40 billion shillings with no rescue plan in sight.

At its prime in 2020, Tuskys had a total of 64 stores, but as of 2023, it has four stores.

According to the then Chair of Tuskys Central Staff Committee Wycliffe Olenabori, in March 2020 the Tuskys branch that he was serving at was selling goods worth a whopping 1.5M kshs per day.

But beneath this public display of leadership and innovation, Tuskys was experiencing a serious case of internal bleeding.

“On March 17, the CEO told us they were planning to do a 20%–30% pay cut. Within 3 days, we were told by the CEO that the proposed pay cut was to support the company but only he would take it. In April the lowest earning were subjected to a pay cut of 20%. Union wrote to the employer. Employer refused to stop unlawful deduction. We filed a dispute. We went to court. The courts gave interim orders barring employer from further deductions. The same employer also fired 80 employees. The reason for redundancies was covid-19….in July they stopped paying worker’s salaries altogether. We went to court again.” Wycliffe Olenabori, chair person, central staff communications Tuskys says.

Between March and October 2020, 14 branches closed down. Dwindling stocks and complaints from unpaid staffers became the norm at the remaining 50 branches.

“In April, stocks went down. After that they told us to go on unpaid leave. The outsourced employees are the ones who went for that unpaid leave. Customers disappeared. Then in July, our salary stopped… Up to date. And they don’t care, and they aren’t telling us what is happening. We are parents. We have families. We need school fees. It has been very difficult. We are stuck,” Sarah Mwashigadi an employee at the Tuskys Thigiri says.

A company that was ready to bail out Nakumatt three years ago had no choice in August 2020 but to sign a term of agreement with a faceless and unnamed Mauritius based fund for the provision of a financing facility worth 2 billion kshs.

This injection was part of what they needed to clear a 6.2 billion kshs supplier debt amongst other obligations.

Some creditors, having seen this pattern before could wait no longer and in October 2020 the retailer had to get a reprieve from the High Court which barred a home appliances and electronic dealer, from trying to dissolve the troubled chain, over a sh248 million debt.

In less than 8 months, the leading supermarket in the country had gone from a shining family-owned jewel to a tragic retail twist.

Financial analysts point out that throughout its growth, Tuskys remained dangerously exposed as an exclusively family-owned retail business.

Now to understand the retail sector in this country you have to go back 40 years, specifically to the 1980’s in Kenya’s ‘retail Silicon Valley’, Nakuru county where Nakumatt, Tuskys, Naivas and even Quickmart hail from.

And coincidentally, the founders even had some business dealings together in those formative years.

By 1982 Nakuru mattresses was the forerunner there with at least 2 stores but 30km away from town in Rongai, the late Joram Kamau had already dipped his toes into the retail sector and was giving it another try, this time with a shop called magic super store that initially dealt with mattresses before expanding its offering.

The father of nine would encourage his children to get involved in the family business as soon as they were done with basic education.

The highly religious founder would get certain goods at almost no charge from Mangalal shah, the founder of Nakumatt which he would then sell at discounted prices.

Thus, as he prospered, Kamau left the Rongai store to his brother peter mukuha kago, who transformed this into Naivas supermarkets, currently the country’s largest supermarket chain.

Joram Kamau’s family also opened a supermarket on pandit nehru street in nakuru town.

But the business took a turn for the better when Joram Kamau with the help of Nakumatt’s Mangalal shah was able to open his first branch in Nairobi on Mfangano street right here in 1988.

Over the next few years the company expanded its branch network by strategically placing their stores near bus stations and offering low prices on goods as compared to their competitors. Yet few details were still publicly available about the family behind the million-dollar supermarket chain.

Twelve years later, in 2002, Joram Kamau passed on leaving the 8-store supermarket in the hands of his children.

Meanwhile as all this was going on, Tuskys continued to expand and in 2015 the supermarket chain celebrated 25 years of existence with a roadshow in nairobi and other parts of the country.

At the same time in May the supermarket appointed its first non-family chief executive officer, former internal auditor Dan Githua as it announced plans to list on the Nairobi Securities Exchange (NSE) within five years.

But whilst all looked rosy in public, behind the scenes one of Tusky’s banking partners was jittery about the management of the family-owned business and in 2016 three independent executive directors and a host of professionals were brought on board steer the supermarket chain to higher heights.

And before the new management team could settle in, the unexpected happened as the family squabbles bubbled to the surface once again. This time round it was the grand-children who stormed the company headquarters to kick out the newly-appointed CEO Dan Githua …and that clip quickly went viral on social media

“We heard noise, and the noise was so loud. Grandchildren had come in numbers with their friends. John kago was trying to plead with sons and nieces…leave this guy alone. The guy was thrown out of the office. Next day we prepared press statements. We told the MD to stay a little bit until the situation cooled down,” a source who did not want to be named told Citizen TV.

The CEO eventually resumed his duties but the new team slowly started unravelling corporate governance gaps in the procurement and finance departments, with all their questions receiving little if any responses.

At its peak Tuskys boasted of a branch network of nearly 70, in Kenya and Uganda and whilst this may have looked like an indication of dominance in the market, the science behind the expansion was lacking.

Another bone of contention in early 2015 was the move by the new CEO Githua and some of the directors of the supermarket chain to bring in, a company meant to provide staff outsourcing services to Tusky’s supermarket.

By 2017 the non-family management team quietly exited the company after they realized that their strategies were not being implemented by the company. At this time all public focus was on Nakumatt who were struggling to stay afloat and Tuskys despite the internal challenges seemed keen to offer a helping hand to them financially.

In May 2020 it emerged that Tuskys had written to suppliers, banks and landlords citing constrained cash flows due to the impact of coronavirus on its business.

Specifically, Tuskys stated that measures taken to control the spread of the coronavirus such as social distancing and reduced operating hours for lower traffic in its stores.

Tusky’s is the second family-owned supermarket chain to run into financial headwinds in the space of five years.

Currently Naivas, Carrefour, and Quick Mart are currently the fastest-growing retail chains that are backed by deep-pocketed equity and debt investors.

![Festus Makori and Jerica Muthoni. [Lilian Chepkoech]](https://mkenyaleo.co.ke/wp-content/uploads/2024/04/Q16uLG6Y0KB9b14AiLHv6W3TOXDWD0bftwRfm4YQ-390x220.jpg)