The Affordable Housing Project, according to Githunguru MP Gathoni Wamuchomba, is a land-grabbing project.

The MP asserted that the program is a scheme to appropriate land from its legitimate owners and transfer it to other individuals.

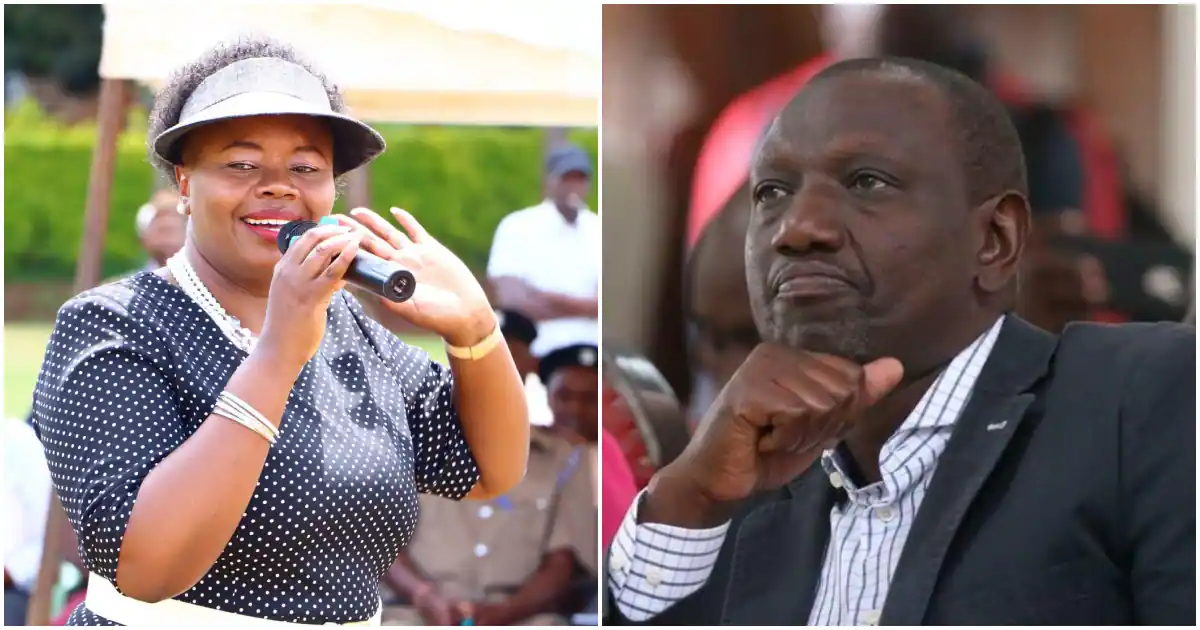

Speaking on Spice FM on Thursday, Wamuchomba asserted that the show is a scandal waiting to happen.

“Housing Levy is the most contentious issue and the legal framework that has been managing the issue of housing to me is still not very clear,” she said.

“When I said this is scandalous I meant that there are schemes of taking over prime land and handing over that land to other players unconstitutionally, unprocedurally, and irregularly and some of us will pay for what we are doing in future.”

The lawmaker has led the charge in criticizing the Finance Act 2023, which brought in a number of new tax regulations.

But President William stated that the project’s goal is to enable regular people to become homeowners during his remarks at the groundbreaking of the 1,400-unit Buxton Point Affordable Housing Phase 2 and the 2,000-unit Mzizima Affordable Housing Phase I in Mvita, Mombasa County.

President Ruto stated that the affordable housing program is essential for the creation of employment opportunities for youth, whose targeted employment capacity is expected to hit 500,000 jobs by 2027, following the court’s recent ruling that the new housing levy of 1.5% of gross salary is unconstitutional.

“If we don’t engage these people (youth) in productive work, they will become a very big challenge to all of us,” Ruto said.

The President observed that low-income earners will pay an interest rate of as low as 3 per cent a year as compared to the market rate of 18 per cent annually.

The Ministry of Housing and Urban Development, however, said all employers must continue deducting the Affordable Housing Levy from their employees.

Lands CS Alice Wahome said the levy remitted should include the employers’ contribution.

This is 1.5 per cent of the employee’s earnings to the fund with employers required to match an equal amount.

The Ministry warned that employers who fail to deduct the levies will be penalised as per the law.

“Please note that the employer’s contribution to the Affordable Housing levy is an allowable deduction under Section 15 of the Income Tax Act,” Wahome said.

“An employer who fails to comply with the law shall be liable to payment of a penalty equivalent to two per cent of the unpaid funds for every month if the same remains unpaid.”