Starting on Tuesday, August 15, you will be allowed to use and hold 500,000 shillings every day in your M-Pesa account.

This comes after the Central Bank of Kenya (CBK) approved Safaricom’s request to raise the M-Pesa account limit to Sh500,000, putting commercial banks, microfinance institutions, and online lenders in direct competition with the telecom.

With the new permissions, Safaricom is effectively transformed into a massive digital bank that will move the battle for clients’ phones in the brick-and-mortar banking halls.

Kenyans are not unfamiliar with the idea of a digital bank at a time when the majority of lenders have adopted internet channels in their fight for survival.

Safaricom’s current limit per transaction of Sh150,000 will however remain, the company said. Even then, customers can make as many transactions up to the Sh500,000 daily limit.

The higher limits will allow individuals and businesses to operate their M-Pesa savings and business capital akin to a traditional bank account, enabling Safaricom to take the battle for digital transactions to commercial lenders.

Safaricom said the move is set to be a boost for businesses, especially SMEs, as the share of cashless transactions continues to rise.

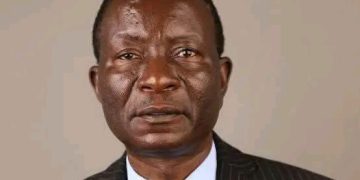

“The increased account limits will provide customers and especially small businesses with increased convenience as the share of cashless transactions continues to rise,” said Safaricom Chief Executive Peter Ndegwa in a statement.

“We appreciate the role that Central Bank of Kenya has played by constantly providing guidance on innovations and protections that we have put in place to strengthen M-Pesa’s adherence to Know Your Customer, anti-money laundering and other financial regulations and safeguards.”

In the last financial year to March 2023, more than 606,000 businesses received payments through Lipa Na M-Pesa, with a total of Sh1.625 trillion transacted in the 12 months, said the telco.

Safaricom has been partnering with commercial lenders on a raft of products that allow banks to reach customers via phones.

M-Pesa transaction limits were previously increased in March 2020 when the CBK approved doubling of transaction limits to Sh150,000 and daily and account limits to Sh300,000.

M-Pesa was rolled out in March 2007 and banks had initially resisted the launch of the Safaricom platform.

Many lenders have since rolled out digital banking platforms, which have in turn cut the need for customers to visit brick-and-mortar outlets for services such as opening of accounts, balance inquiry and paying bills.

Safaricom has for long been experimenting with financial initiatives, including partnering with major local banks.

The telco has also widened the number of services it offers on the M-Pesa platform beyond personal cash transfers.

Merchant and utility payments have gone up, as has the usage of mobile platforms for taking loans from banks and also Safaricom’s own overdraft service, Fuliza.

M-Pesa accounts for about 99.9 per cent of the value of mobile money transactions, underlining the entrenchment of the platform in Kenya’s economy.

The National Treasury in earlier reports warned that any collapse of the M-Pesa service would cause widespread disruption in the economy.

This means M-Pesa is classified as a systemic risk to the country’s economy, underlining its crucial role.