The International Monetary Fund (IMF) has authorized a loan for USD 235.6 million (Sh28 billion) to assist broader economic reforms, better governance, and budgetary support.

The funds issued under the 38-month Extended Fund Facility (EFF) and Extended Credit Facility (ECF), which currently total USD 1,208.2mn, will be paid out in this final tranche.

The agreement aims to enhance governance, support more extensive economic reforms, and help Kenya’s program to address debt vulnerabilities, the government’s reaction to the COVID-19 outbreak, and global shocks brought on by the war in Ukraine.

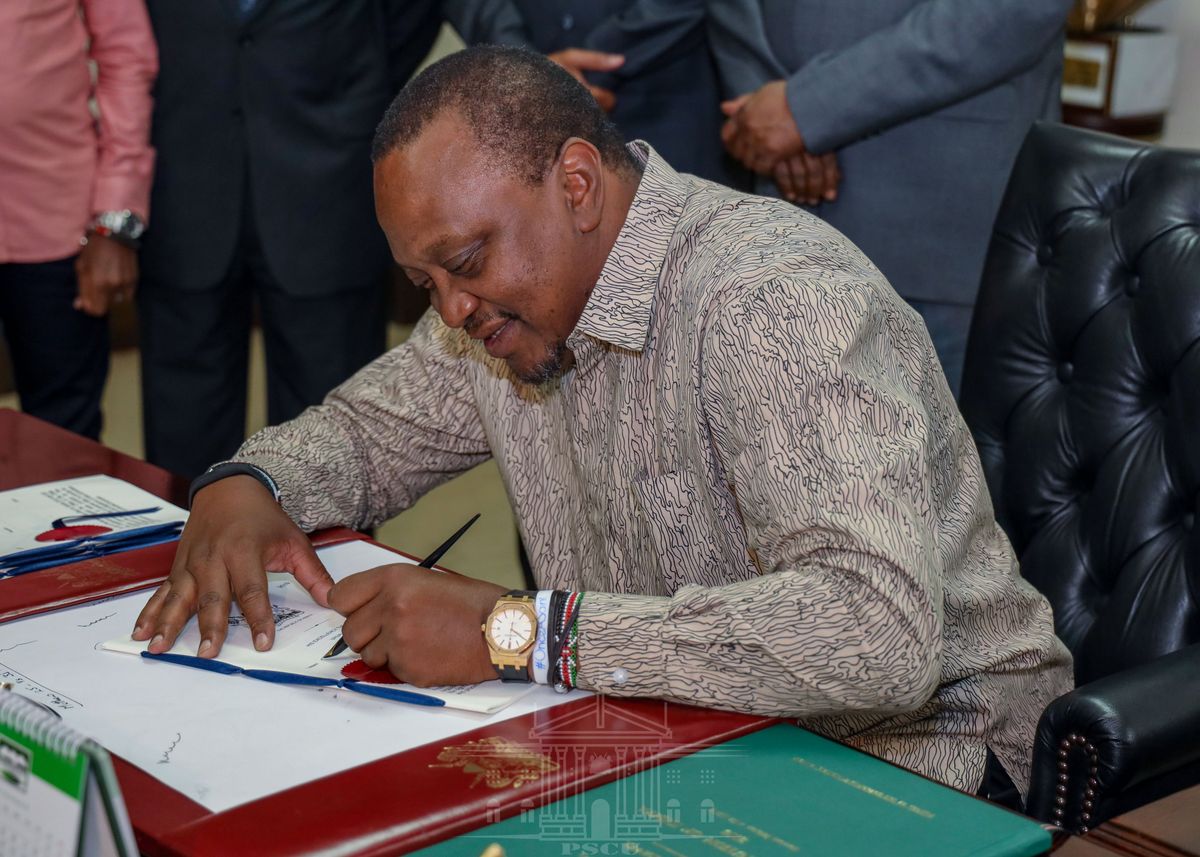

The lender approved the review for Kenya on April 2, 2021, with a focus on reviewing the advancement of the reforms and policy initiatives carried out by the Uhuru Kenyatta-led Government.

Antoinette Sayeh, Deputy Managing Director and Acting Chair of IMF Executive Board, in her remarks, lauded the state for its sustaining “Strong fiscal performance through strong tax revenues’ but emphasized the need to“Maintain the momentum in structural reform agenda.”

“Strong fiscal performance is providing a welcome resilience. Looking ahead, the authorities should sustain their fiscal consolidation efforts to reduce debt vulnerabilities, while securing space for needed social and development spending. This requires further improving spending efficiency and undertaking additional tax policy and revenue administration measures drawing from the forthcoming Medium-Term Revenue Strategy,” Sayeh said.

In order to cushion Kenyans from higher fuel prices, IMF urged the Government to also implement targeted programs to support vulnerable households.

” Although the authorities are adjusting domestic fuel prices to international levels more gradually, more targeted programs to support vulnerable households should accompany the ongoing review of the fuel pricing mechanism and plans for reforms to ensure that pricing actions are always aligned to the approved budget,” the lender pointed

In its remarks, IMF also lauded the Central Bank of Kenya’s monetary policy tightening which is pegged on a flexible exchange rate, it urged the regulator to be ready to adjust its stance to limit second-round effects from higher food and fuel prices and to keep inflation expectations well-anchored.