In a scandal so brazen it defies belief, top executives of the Kenya Union of Savings & Credit Co-operatives Ltd (Kuscco) forged the signature of a dead auditor to approve fraudulent financial statements—an elaborate cover-up that masked the theft of Ksh 13.3 billion.

A forensic audit by PwC unearthed a web of deceit spanning seven years, revealing cooked books, large-scale theft, bribery, and money trails disappearing into thin air.

The umbrella body for saccos now stands insolvent by Ksh 12.5 billion, and the deposits of 247 saccos—a staggering Ksh 24.8 billion—hang in the balance.

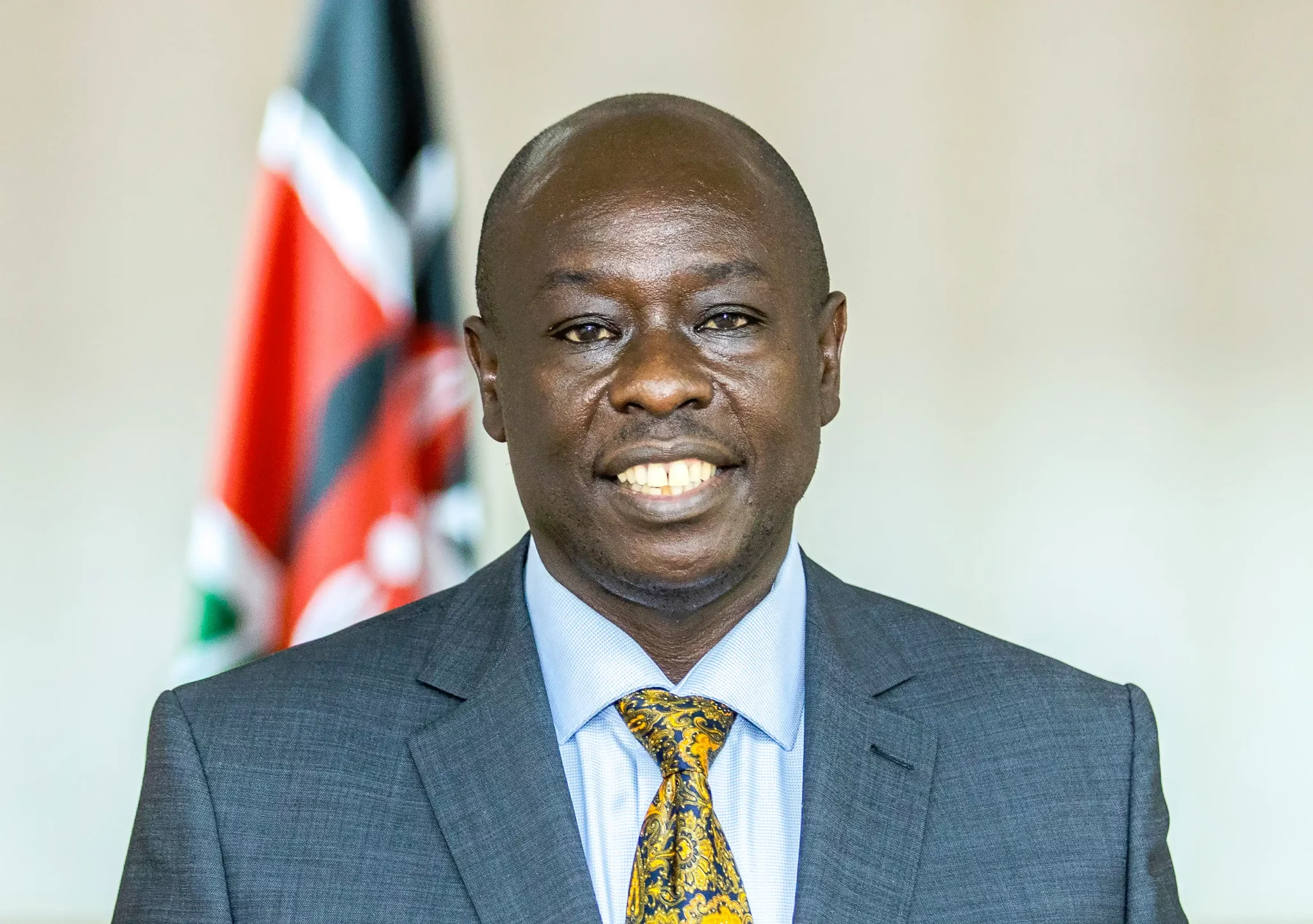

At the center of the storm: a trio of powerful executives—Managing Director George Ototo, Finance Manager George Owino, and Chairman George Magutu. They allegedly ran Kuscco like a personal piggy bank, engaging in sham contracts, fraudulent interdepartmental loans, and outright looting through unexplained cash withdrawals.

Among the shocking revelations:

🔴 A Dead Auditor’s Signature – External auditor Alfred Basweti had been long deceased when his name mysteriously appeared on the 2022 financial statements. A ghost signed off on Kuscco’s lies.

🔴 Phantom Profits & Cooked Books – The audit uncovered a Ksh 9.3 billion misstatement, hidden expenses of Ksh 3.7 billion, and a staggering Ksh 6.5 billion in concealed lending.

🔴 Executives’ Secret Payouts – Ototo and Owino personally pocketed Ksh 107.3 million in advance commissions—without a shred of proof they brought any business to Kuscco.

🔴 Fictitious Land Deals & A Fake Radio Station – Kuscco paid Ksh 35 million for a radio station that never launched, justifying it with a forged land sale agreement for property that doesn’t even exist—it’s actually part of Ololua Forest!

🔴 Loans That Should Never Have Existed – Top managers took massive loans far beyond their deposits, defaulting on Ksh 489.2 million while ordinary members played by the rules.

🔴 Vanishing Millions – Ksh 206 million simply disappeared from Kuscco’s savings bank account under the guise of cash transfers to branches.

Despite damning evidence, the accused refused to be interviewed by PwC, instead responding with thinly veiled threats. When questioned by the media, Ototo snapped: “With respect, keep off. You may end up personally responsible.”

Now, Kuscco teeters on the edge of financial ruin. Its reckless leadership gambled with billions, leaving a once-trusted institution in free fall. And as depositors stare at potential losses, the burning question remains: Will justice be served, or will these masterminds walk free?

Read more on https://www.businessdailyafrica.com