The Directline Assurance Company has reportedly shut down, losing over 60% of the Kenyan market for insurance on public service vehicles (PSVs).

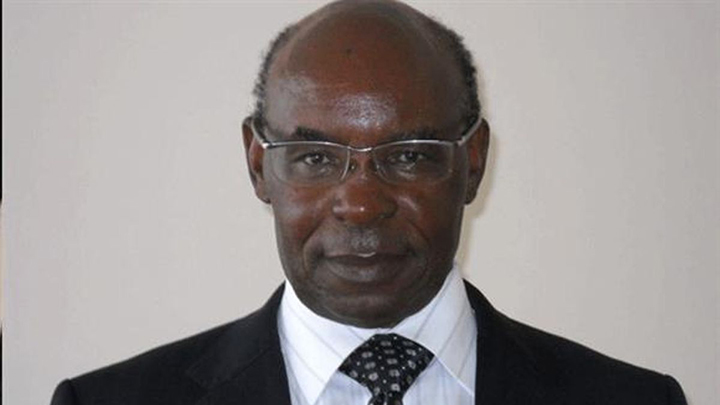

The insurance company’s owners, Royal Credit Limited, led by Dr. SK Macharia, made the announcement that all of Directline’s staff would be let go in a brief statement.

In addition, he announced the immediate dissolution of the Board of Directors of the company, with Royal Credit Limited slated to assume ownership of all Directline assets.

According to Macharia, the closure of Directline Assurance Company was prompted by freezing of the company’s bank accounts by the Insurance Regulatory Authority (IRA).

Macharia further faulted IRA for failing to take action against the company’s former directors whom he accused of mismanaging funds totaling Ksh7 billion.

Following the controversial decision, the company announced the immediate suspension of all insurance services.

The latest development has left the transport industry in dismay the company being the leading motor vehicle insurance company in the country.

Directline joined the Kenyan market in November 2005 as a motor vehicle insurance company.

In the 2022/2023 fiscal year, Directline Company’s income stood at Ksh4.1 billion, up from Ksh3.6 billion the previous year.

The company attributed the profit hike to partnerships with market intermediaries including 3200 agents, 83 brokers and 17 banks.

While announcing its profits earlier this year, the company outlined its ambitious plans to diversify its portfolio of products.

In a bid to transform its operations, in February this year, the company announced its transition to cashless fares in a bid to curb fraudulent claims emanating from injuries to deaths of passengers.