The African Union (AU), through its African Peer Review Mechanism (APRM), has criticized Moody’s Global Credit Rating Agency for its recent decision to upgrade Kenya’s economic outlook from negative to positive.

Moody’s had cited improvements in the country’s economy, including a potential reduction in liquidity risks and enhanced debt affordability over time, as the basis for the upgrade.

However, in a statement issued on Monday, January 27, APRM argued that Moody’s decision to bypass a “stable” rating and jump directly to “positive” was a mistake.

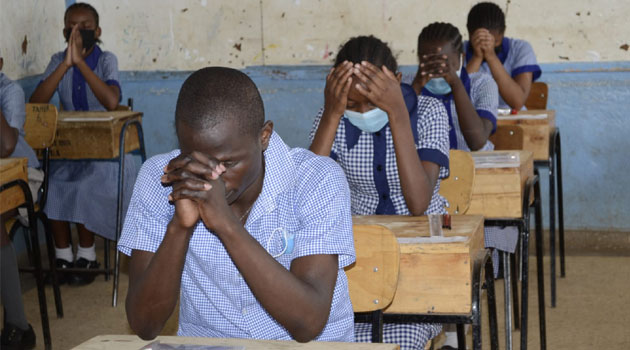

“This rating action was a reversal of Moody’s premature rating action on July 8, 2024, which was largely driven by protests in Kenya over the proposed Finance Bill,” the commission stated.

APRM accused Moody’s of attempting to correct an error it made last year when it downgraded Kenya’s economic outlook to negative.

President William Ruto, speaking during a church service in Nairobi on Sunday, January 26, welcomed Moody’s recent decision, linking it to the economic policies implemented by his administration.

“Just yesterday, we got good news about what God is doing to heal our nation. Working together, we have seen inflation numbers, interest rates, and exchange rates coming down,” President Ruto said.

APRM, however, termed last year’s downgrade to “Caa1” from “B3” as speculative and premature, noting that Moody’s had issued the rating before critical data, including the Appropriation Bill, the budget, and the Finance Bill, was available.

Moody’s ratings

Kenya has been struggling with heavy debt and looking for new financing lines since last year due to nationwide protests against proposed tax increases.

Domestic financing costs have started to decline amid a monetary easing cycle and this could continue if the Kenyan government effectively manages its fiscal consolidation, opening doors for external funding options, the report said.

“Given low inflation and a stable exchange rate, there is potential for further reductions in domestic borrowing costs as past monetary policy rate cuts pass through to lower long-term borrowing costs,” Moody’s said.

The agency added that a new International Monetary Fund program would enhance Kenya’s external financing while other multilateral creditors such as the World Bank will continue to be significant financing sources, even without the IMF funding.

The agency affirmed Kenya’s local and foreign-currency long-term issuer ratings at “Caa1”, citing still elevated credit risks driven by very weak debt affordability and high gross financing needs relative to funding options.

READ ALSO: Glovo Chooses Nairobi for its Largest Global Real-Time Operations Hub