According to Knight Frank’s 2017 Prime Global Cities Index, Nairobi is the only African city in the top 45 global cities that had growth in the previous year.

Kenya’s capital, which is ranked 32nd, saw a 3.5 percent increase in growth from the first quarter of 2021 to the first quarter of 2022. Between Q3 2021 and Q1 2022, the city had a 2.4 percent change, and a 1.3 percent change between Q4 2021 and Q1 2022.

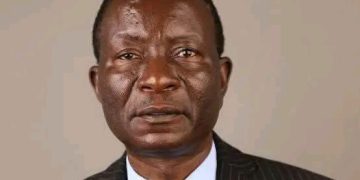

“This growth can be attributed to pent-up demand. After two years of the pandemic, as we entered Q4 2021 there was a sense of normalcy returning. I believe buyers’ sentiments to get on with life motivated their purchasing resumption plans. Also with the pandemic seemingly behind us we witnessed many expatriates returning to Kenya,” stated Tarquin Gross, Head of Residential Agency at Knight Frank Kenya. As we approached Q4 2021, a semblance of normalcy has returned after two years of pandemic. I expect buyer sentiment to improve.

The city with the fastest rising prime prices in the study period was Dubai in the Middle East, with a 58.9% change in a year and a 23.2 percent change in six months from the third quarter of 2021 to the first quarter of 2022.

The next four cities are all from North America, with Miami City coming in second and Toronto coming in third. The top five places are filled by San Francisco and Los Angeles.

The Prime Global Cities Index is a valuation-based index that uses data from the Knight Frank research network to measure the movement of prime home prices in 45 cities around the world.

Since the outbreak of the pandemic, the price increase of prime properties has slowed, according to the research.