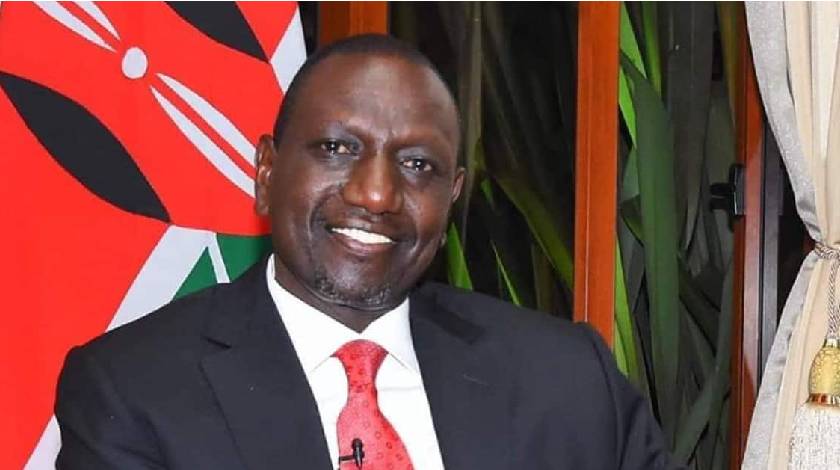

Following a public outcry, President William Ruto explained the Hustler Fund loan limit on Wednesday, November 16.

At the State House during a meeting of the Kenya Kwanza parliamentary group, Ruto clarified that the Ksh50,000 loan cap applied only to individual borrowers.

He went on to say that the Hustler Fund would offer three different types of products: for individuals,

“The amount of money available on the personal loan platform is Ksh500 – Ksh50,000.

“The next product for chamas will start from Ksh50,000 to Ksh250,000, then the next one will climb up like that as we continue to roll out the fund,” Ruto stated.

Hustler Funds’ individual package will be launched on November 30, based on credit scoring. Those with good loan performance will enjoy more loans and higher limits and vice versa.

The President explained that all persons who take up loans will be required to save a certain percentage, to which the government will contribute 50 per cent of the total amount saved.

“We have made it mandatory that as you borrow, there is a saving component. If you borrow Ksh1,000, Ksh50 goes to your saving. For every amount to save, the government of Kenya is going to match it 2:1,” he stated.

Ruto added that four per cent of the fund would be used to set up the technology to run the disbursement of the fund, including a call centre which will provide customer service to the loanees.

In addition, he assured that the Hustler fund product is self-sustaining, with measures put in place to cushion the fund even in the event of defaulters.

“We have put in a component pf twp per cent so that if there are any defaulters, they do not reduce the fund. An extra two per cent will also be installed to ensure that the fund grows,” the head of state added.

Ruto announced that all applications for the fund will be done online and disbursed through mobile money wallets.

“The product will be seamless as you will not need any paperwork. It will be online just like mobile money transfer and people will be able to borrow using a designated USSD number,” he expounded.