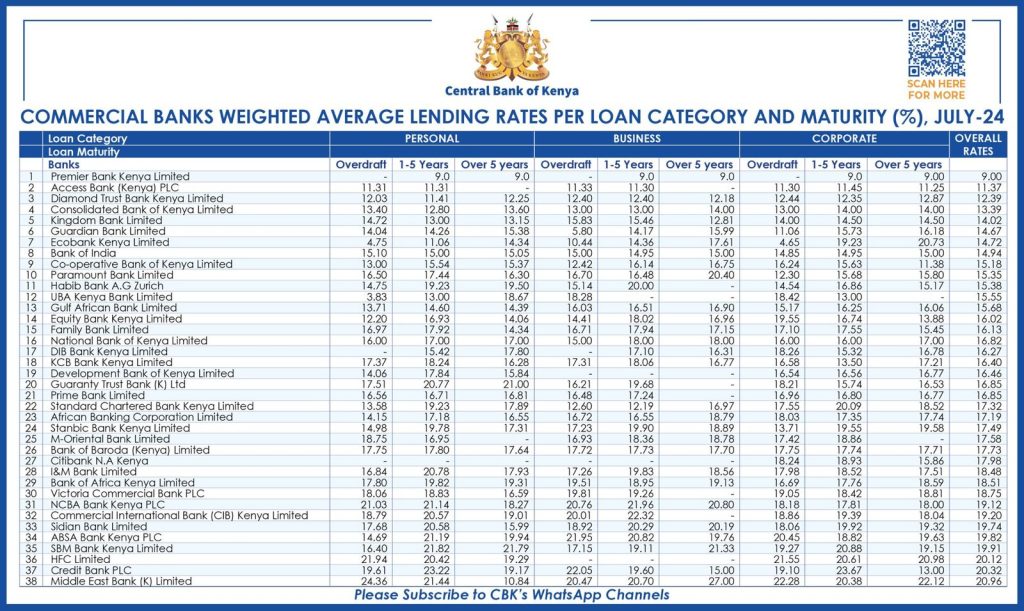

Banks in Kenya are charging average interest rates of between 9 and 20.96 per cent for loans before factoring in borrowers’ credit profiles.

The latest Commercial Banks Weighted Average Lending Rates report by the Central Bank of Kenya (CBK) shows that Premier Bank Kenya is the least costly lender at nine per cent, way below the base lending rate of 12.75 per cent.

Middle East Bank has the most expensive loans in the country, averaging 20.96 per cent.

The Nigeria-based Access Bank which plans to acquire the National Bank of Kenya from KCB Group Plc is the second cheapest lender in the country, charging an average interest rate of 11.37 per cent.

Diamond Trust Bank, Consolidated Bank and Kingdom Bank, a subsidiary of Cooperative Bank Group close the list of the top five least expensive banks in the country, charging an average of 12.4, 13.3 and 14.02 per cent respectively.

According to the report, Cooperative Bank is the most affordable lender amongst top-tier banks in the country, charging an average of 15.18 per cent for different loan products with maturities ranging from an overdraft to over five years.

Cooperative Bank’s weighted average lending rate is way below the industry’s average which has since risen to 16.3 per cent from 15.8 per cent in the past three months.

The report shows that the lender is charging the third lowest interest rate on long-term loans for corporate clients at 11.3 per cent after Premier Bank and Access Bank which are charging nine and 11.2 per cent respectively.

KCB and Equity Bank which are top lenders in the country in terms of asset value are charging an average of 16.4 and 16.2 per cent respectively for various loan products.

NCBA and Absa are among the least affordable Tier 1 lenders in the country, charging 19.91 and 19.12 per cent respectively.

Others like Standard, Stanbic and I&M are charging 17.3, 17.5 and 18.48 per cent.

Premier and EcoBank are offering the lowest interest rates for personal short-term loans at nine and 11.06 per cent respectively, making them ideal for most borrowers in the country.

Credit Bank and Middle East Bank are the most expensive in the personal short-term category, charging 23.2 and 21.4 per cent in that order.

For overdraft facilities, Access Bank, DTB and Equity Bank are offering the lowest rates in the country at 11.3, 12.03, and 12.2 per cent respectively.

Middle East Bank and HFC are the most expensive in that category at 24.3 and 21.94 per cent.

Premier Bank and Access Bank are likely to go to lenders by businesses looking for affordable short-term credit facilities as the two are charging the lowest rates at nine and 11.3 per cent.

Commercial International Bank (CIB) and NCBA are offering the highest rates in that category at 22.3 and 21.98 per cent respectively.

High bank rates have stifled the country’s economy in the past year after CBK went on a base rate hiking spree to stem inflation which hit a high of 9.6 per cent in October last year.

The regulator followed the global trends to hike the rate six times in a row to a 12-year high of 13 percent in February.

Early this month, CBK’s Monetary Policy Committee (MPC) cut its base rate to 12.75 per cent.