Digital lenders have raised concerns over the proposal in the 2023 Finance Bill requiring them to pay 20% excise duty on “any amount charged in respect of lending.”

According to the Digital Financial Services Associations of Kenya (DFSAK) chairperson Kevin Mutiso, the move is discriminatory because other financial institutions are simply required to pay the tax on ‘other costs’.

In his view, Mutiso says that Kenyans will be majorly affected if the Bill is passed as it is.

This is because lenders will pass over the new cost to borrowers, which will be 0.8% to 1.9% more expensive.

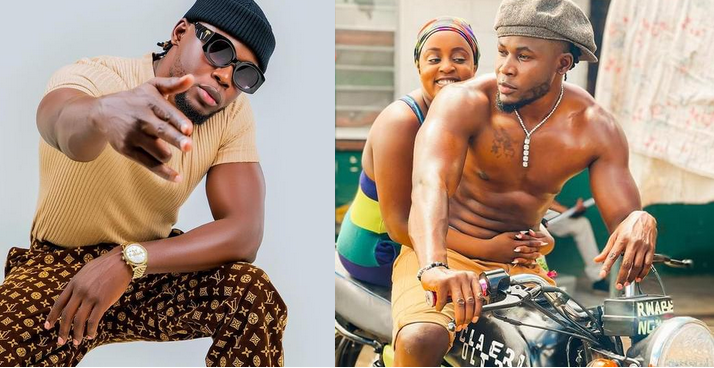

“The most affected are going to be informal sector entrepreneurs; mama mbogas, boda boda riders, traders, micro and small enterprises – Kenyans who weren’t able to get loans from banks a few years ago.

Over 8 million Kenyans who rely on our loans every month are going to be negatively affected,” DFSAK chairman Kevin Mutiso stated.

This means that for a Ksh1,000 loan, the new excise duty will be between Ksh40 and Ksh60. That is, if you apply for a Ksh1,000 digital loan from July 1, you will likely receive Ksh940 even though you will pay interest on the full Ksh,1000.

Digital Lenders’ proposal

According to their submissions, the digital lenders are advocating for a level playing field in which all financial institutions bear the same credit cost.

Their request is that either all financial institutions be required to pay the same tax as DCPs, or the tax be repealed and all lenders continue to be subject to the current tax framework in which interest and loan returns are free from excise duty.

“A fair playing field, we just want to pay the same taxes as everyone else. This is the same product, same channel, same tools being used to do credit scoring and KYC verification. The only difference is the entity that’s issuing. That’s not fair,” says Mutiso.