More than 1,000 Chief Executive Officers (CEOs) have voiced concerns over the government’s abrupt changes in tax policies, cautioning that such unpredictability could hamper Kenya’s projected economic growth in 2025.

A recent survey conducted by the Central Bank of Kenya (CBK), published on Tuesday under the Chief Executive Officers’ Survey, revealed that business leaders are urging the government to create stability in taxation policies to foster investor confidence and economic progress.

The CEOs, drawn from leading private sector organizations such as the Kenya Association of Manufacturers (KAM), the Kenya National Chamber of Commerce and Industry (KNCCI), and the Kenya Private Sector Alliance (KEPSA), highlighted how frequent changes in tax structures create uncertainty, making it harder for businesses to plan and invest.

Their concerns come amid optimistic economic forecasts, with many CEOs expecting an upturn that could lead to job creation and enhanced economic performance.

The survey attributes this projected growth to favorable weather conditions and macroeconomic stability, including a strengthening shilling, lower interest rates, and reduced inflation.

However, the cost of doing business remains a major challenge, with unpredictable tax adjustments cited as a key issue.

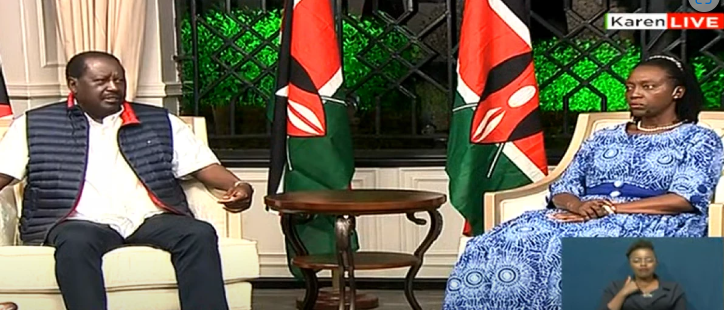

Tax Policy Shifts Under President Ruto

Since President William Ruto took office in 2022, Kenya has witnessed sweeping tax reforms and statutory deductions, including changes to policies on affordable housing, the Social Health Authority (SHA), and National Social Security Fund (NSSF) contributions.

SHA contributions were set at 2.75% of gross salary, with self-employed Kenyans or those in the informal sector required to pay Ksh300 monthly for access to services.

NSSF contributions were capped at Ksh4,320 per month, up from Ksh2,160, following a key business law signed by President Ruto in December 2023.

Under the Affordable Housing Act, 2024, employees must contribute 1.5% of their gross salary, with employers matching the amount, totaling 3% per employee.

These policy changes have sparked national debate, with mixed reactions from citizens and businesses regarding their economic impact.

Call for Business-Friendly Policies

Beyond taxation, CEOs are urging the government to implement policies that improve access to credit, as many businesses still struggle to secure funding despite declining interest rates.

The private sector leaders emphasized that a stable tax and regulatory environment is crucial for sustaining economic momentum, fostering investment, and unlocking Kenya’s full economic potential.