Kenya’s public wage bill has reached unprecedented levels, with the government now spending KSh 80 billion per month on salaries, according to Treasury Cabinet Secretary (CS) John Mbadi.

This translates to nearly KSh 1 trillion per year, raising concerns over the sustainability of government expenditure.

An Expensive Government

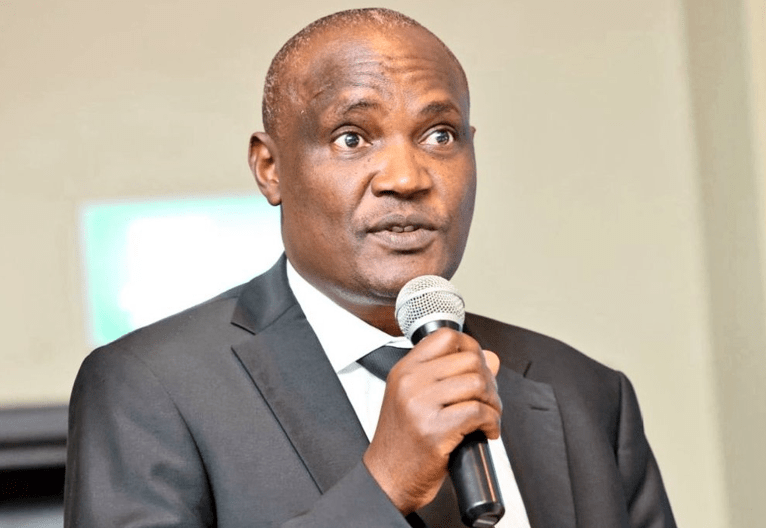

Speaking during a TV interview on March 19, CS Mbadi described the current administration as “an expensive government”, emphasizing the urgent need for financial prudence.

“We have a very expensive government. Today we are paying KSh 80 billion per month at the national government level for salaries. Per year, it is KSh 960 billion—it’s going to a trillion,” Mbadi stated.

With the Kenya Revenue Authority (KRA) collecting KSh 2.5 trillion annually, Mbadi highlighted that KSh 1.1 trillion is allocated to loan repayment, leaving little room for development spending.

“We are collecting KSh 2.5 trillion and spending about KSh 1.1 trillion on loan repayment. So, where do you get money for development? That is why sometimes our economy is sluggish,” he added.

Development at Risk Amid High Expenditure

The high wage bill and loan repayment obligations continue to strain government finances, affecting essential public investment.

With limited funds available for development projects, Kenya has become increasingly reliant on external grants and loans from development partners to sustain growth.

Mbadi acknowledged the role of development partners in keeping the country’s economy afloat:

“We are lucky that we have some development partners who pump in money in the form of grants, which help us to grow.”

Managing Kenya’s Budget Deficit

While the government recognizes the burden of high spending, borrowing remains necessary to bridge Kenya’s budget deficit. However, Mbadi emphasized that the focus should be on managing the deficit to ensure economic sustainability.

“On the budget deficit, the strategy is not to stop borrowing. No country in the world does not borrow. What you must do is to consistently manage your deficit as a percentage of GDP.”

With Kenya’s public debt rising and development funds shrinking, economic analysts warn that bold fiscal reforms are needed to curb excessive spending and improve efficiency in government operations.

The Way Forward

- To address the wage bill crisis and economic stagnation, experts suggest:

- Public sector reforms to reduce excessive government spending.

- Revenue enhancement measures to boost tax collection efficiency.

- Debt management strategies to ease the burden of loan repayments.

- Increased private sector participation in development projects to reduce reliance on public funds.

As Kenya navigates its economic challenges, the government must strike a balance between borrowing, expenditure control, and sustainable growth.

How well the administration implements fiscal discipline will determine the country’s financial future in the coming years.