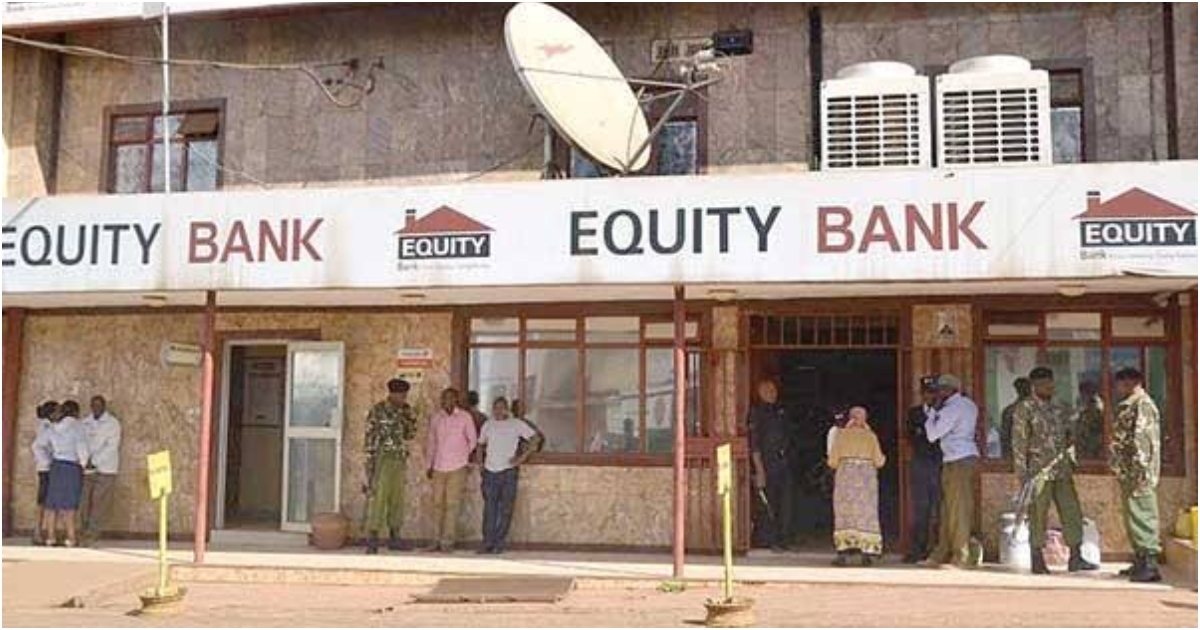

The Daily Nation reported on Thursday that the second-largest lender in Kenya, Equity Bank, lost KSh 1.5 billion to an insider and his father last month. According to reports, the Banking Fraud Unit is currently looking into the matter.

With no matching credits on Equity’s ledger, the pilfered funds which were intended for employee salaries—were moved in 47 transactions to various accounts in different banks.

The lender reported the theft to the Banking Fraud Investigations Unit after determining that they had been authorized to use a manager’s credentials. The transactions set off internal controls.

BFU then arrested the manager, David Machiri Kimani, 39, who was on leave at the time of the heist, and his father, Joseph Kimani Machiri, and asked the Chief Magistrate’s Court in Milimani to detain the former for 21 days to finalise investigations.

According to the report, most of the money was moved through newly created accounts registered in the names of newly registered businesses. Investigators believe Kimani Machiri, a founding member of the Murang’a county assembly, was he was his son’s accomplice.

Equity Group, which posted a 12.5 percent growth in profit after tax in the first half of 2024, has had several incidences of stolen funds in its bank subsidiaries. In mid-April this year, hackers stole US$ 2 million from the bank in a debit card fraud. The DCI arrested 20 suspects in connection with the heist.

Around the same time, Ugandan police arrested a former executive and three agency banking operators while investigating a $16mn stock loans and agent float financing fraud. The case had already seen at least four former employees charged in a Kampala court for money laundering, conspiracy to defraud, and obtaining credit by false pretence.

In 2021, a Kigali court sentenced eight Kenyans and a Ugandan to eight years imprisonment for hacking Equity Bank in 2019. The hacker group routinely used insiders and in-country account owners to penetrate the lender’s systems and move their loot.