Jalango: How can I tell MPs content creators don’t have money when they’re showing off millions online?

Content creators in Kenya may soon be required to pay a 15% withholding tax if certain amendments to the 2023 Finance Bill are approved by President William Ruto.

Under the proposed tax regime, income earned through digital content monetisation will be subject to a 15% withholding tax.

The Bill defines digital content monetisation as any payment received for entertainment, literal, social, artistic, or educational material through any medium.

Income earned through affiliate marketing, content licensing, and brand sponsorship will be taxed.

In addition, content creators who offer subscription services, membership programmes or sell merchandise would have income made from these mediums taxed.

The bill has now proceeded to parliament, where the legislators are expected to discuss it.

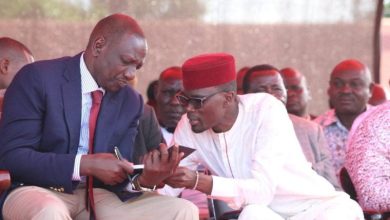

On Friday, Langata MP Felix Odiwuor popularly known as Jalango shared an update on the 15% withholding tax for content creators.

Jalango shares views on 15% withholding tax

Jalango narrated how his fellow legislators put him to task as he tried rejecting the proposal while arguing that content creators are broke.

“I think this is probably the hardest video I’ve ever had to make because of how difficult I found myself in a situation on this finance bill 2023 where there’s a proposal that content creators pay 15% now I am in fifteen percent now I haven’t been so much as big a parliamentary committee meeting on broadcasting we’re content creators and all these people now for and uh…

I am a content creator and I’m supposed to fight for fellow content creators not to pay or they must give a counteroffer to the government on what they wish or willing to pay.

And a quick conversation with my fellow content creators, they told me they are not planning or willing to pay and they have a very big protest coming up, one of them actually being led by my very good friend, Eric Omondi, who is also up in arms that content creators should not pay the 15% tax.

So I walked into the first meeting and I told these people, that these people do not have money. For these content creators, let it go, you might not understand because the government itself just decided to have a blanket a blanket proposal so there’s no been any counter proposal and here is my take on how you people got yourself into this mess.

How do I convince the government or the people who do not understand content creation, that you don’t have money and you are not able to pay the 15% tax, when what you show out there is that you are millionaires.

Now, this is some of the things I was being asked when we were going through different content creators’ pages.

They asked me, for example, your very good friend Oga Obina has turned 33 and he says he’s given himself a very small gift. And this small gift that Obina has given himself is a VW Touareg 2017, 2018, 2019, which will in 2019 which would easily cost him 5 to 6 to 7 million depending on which showroom he buys his car. So Obina has turned 33 and has bought himself a small gift of VW Touareg. 6 million.

Do you know how long it will cost a to save a teacher who’s been taxed to save to ever ever buy that car?

All right I say that is just one of the cases maybe he makes his money from somewhere else that is not content creation and they asked me where else that all is we showed me a video where Ambare claims she spends 300,000 a day. 300,000 per day times 30 days.

“Pages of say Eric Omondi who is a champion of this we can’t pay we don’t have that kind of money and this month alone or the last month Eric made more 10 million Kenya shillings from content creation or even more. If you go to Eric Omondi’s page you can see that any other video creates is doing advertising.”

Since taking office in September 2022, President Ruto has spearheaded activities that have been intended to boost Kenya’s digital economy as the East African country has struggled to generate revenue.

In November 2022, President Ruto disclosed that he intended for the Kenyan Revenue Authority (KRA) to increase its revenue collection to between Sh4 trillion and Sh5 trillion.

The KRA exceeded the Sh2 trillion mark for the first time in June 2022.

According to Jalango, the gov’t will not relent on the tax proposal.

“How I’m supposed to go in front of this panel today to show them that Butita doesn’t have money to pay taxes, that content creation doesn’t pay, or if he has to pay, he can’t pay what you people are asking.

“But then they come and tell me that he runs a whole media house, SPM buzz and he has presenters more than five and they don’t come cheap he has editors he has all these people how I convince them that you don’t have the money to pay 15% tax from what they earn?

“Then I asked myself again, my very good friend Marwa, Marwa the other day told me, talk to president that this tax is so punitive. They went to your page, they’ve seen the villa that you’re building home that will easily cost you more than a hundred million.

We talked about it. Congratulations, by the way. Congratulations, by the way. How do I tell these people that content creation has no money when my very good friend Calligraph Jones is putting a multi-million home?” Jalango concluded.